Introduction

My name is Brian Cohen. I am a chartered accountant, based in north London. I have an accountancy practice.

This website is intended for prospective clients of my accountancy firm. It is a one-page website that enables prospective clients to:

• download a guide to my accountancy practice;

• submit any questions they want to ask me before they decide whether they want my accountancy firm to undertake any accountancy work for them; and

• download the enquiry form that I ask prospective clients to complete and return if they want me to consider undertaking any accountancy work for them.

Who are my accountancy services aimed at?

My accountancy services are aimed at:

• small service-based businesses; and

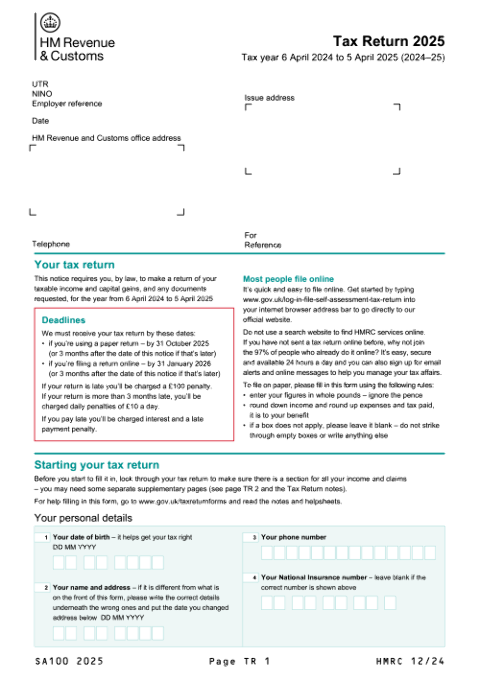

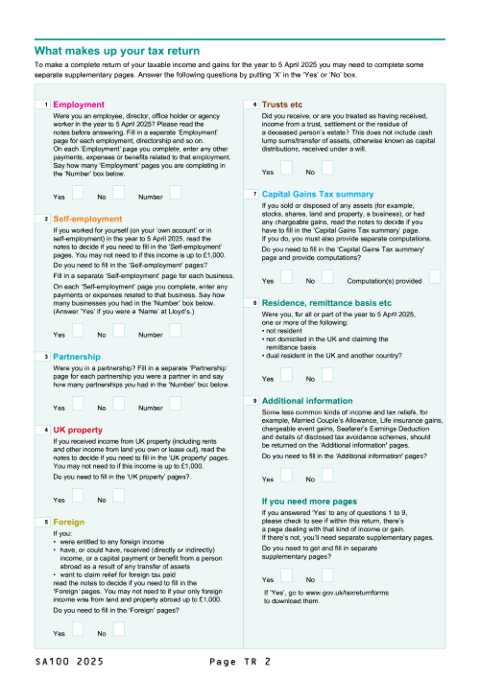

• individuals who need to complete annual self-assessment tax returns for themselves, a partnership, a trust or the estate of a deceased individual.

What are the main types of accountancy work that I undertake?

The main types of accountancy work that I undertake are:

• bookkeeping (preparation of books of account);

• preparation of VAT returns;

• preparation of annual accounts*; and

• preparation of self-assessment tax returns.

* I can prepare annual accounts for individuals and partnerships. I do not prepare final annual accounts (or tax returns) for limited companies or limited liability partnerships (LLPs). However, I can prepare draft annual accounts for a company or LLP, ready for finalisation by another accountancy firm.

High-quality accountancy services at reasonable prices

I provide high-quality accountancy services at reasonable prices. I do this by:

• providing a personal service (I carry out all of my firm’s accountancy work myself);

• providing a professional service;

• providing a visiting service;

• providing efficient accountancy services; and

• charging reasonable fees for my accountancy services.

• NW1, NW3, W1, WC1, WC2, EC1, EC2 and EC3.

• EN4 and EN5.

What to do next if you are interested in appointing me to undertake any accountancy work for you

If you are interested in appointing me to undertake any accountancy work for you, please follow the instructions included in the sections below.

Contact form

If you wish to contact me, you can use the following contact form to send me a message.